Wealth management product administration

Composer

Administration technology helping superannuation funds, investment platforms and managed funds improve efficiency and ensure regulatory compliance

Delivering automation and compliance

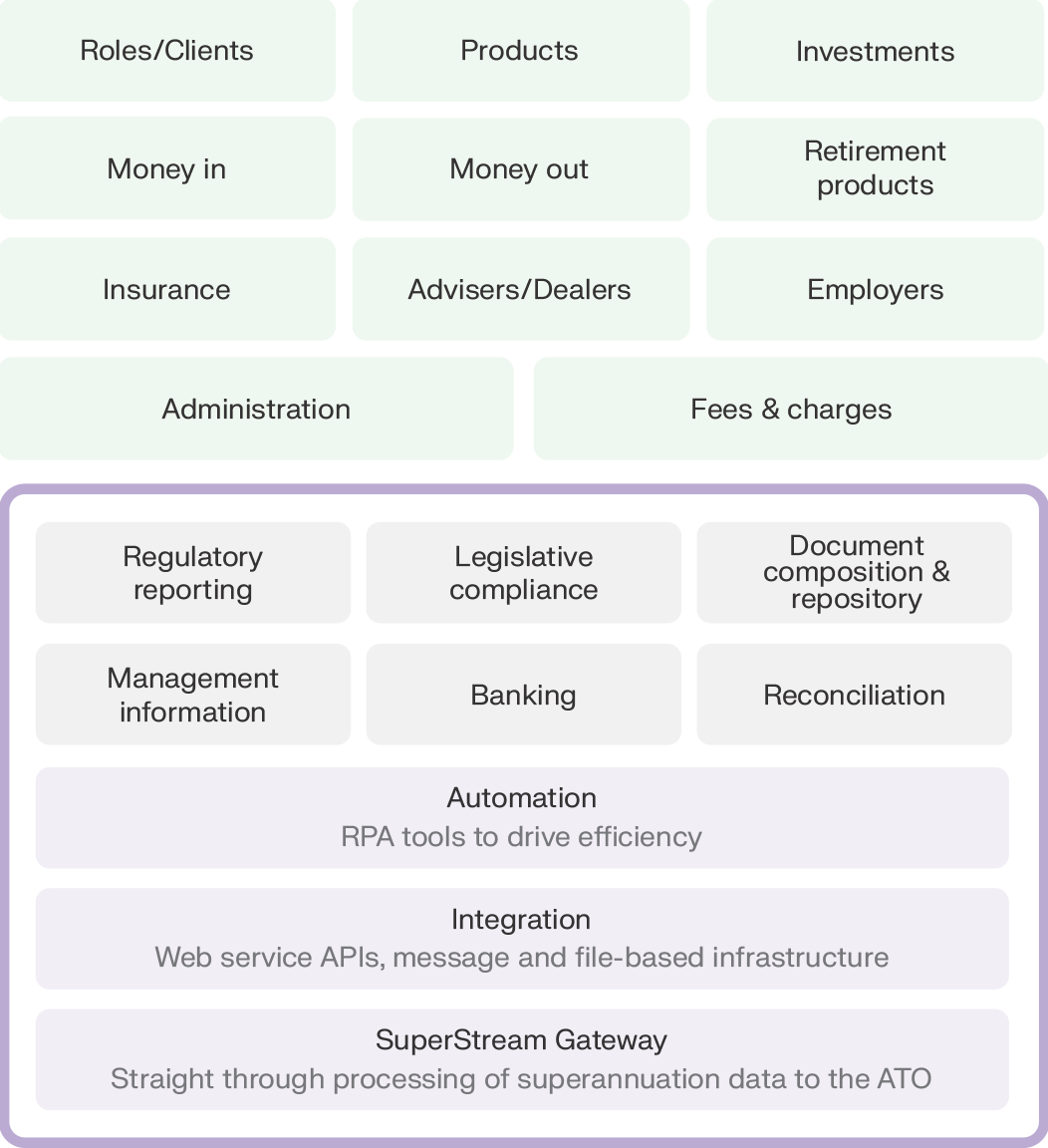

Composer offers a comprehensive suite of solutions to streamline the administration of wealth management products from the distribution channel through to the back office.

- Enhance operational efficiencies and lower costs with Composer’s intuitive user experience and straight-through processing capability, automating key back office processes to reduce manual effort and minimise errors

- We monitor the ever-changing regulatory landscape and update our systems when required so you’re always compliant – as part of our standard licence fee

- Tailor Composer to meet your needs today and in the future, with scalable architecture and single code base that is easily configured to support your growth

Operational Risk Management (CPS 230)

APRA recently registered a new Prudential Standard, CPS 230 – Operational Risk Management (CPS 230). Key requirements of CPS 230 are that organisations must identify, assess, and manage their operational risks with effective internal controls, monitoring, and remediation. Additionally, there must be a credible business continuity plan ensuring that organisations are able to continue to deliver their critical operations if funds suffer severe disruptions. Boards should begin to consider now how to meet these new commitments, with APRA being clear that there will be serious consequences.

As a company, we prioritise compliance and operational excellence, meeting all the management of operational risk and business continuity requirements that Providers, Trustees, Boards, and senior management now require from their key suppliers. GBST adheres to CPS 230 compliance standards and our commitment involves rigorous risk assessments, robust policies, ongoing training, and regular audits. This ensures not only regulatory adherence but also a steadfast dedication to transparency, security, and the success of our client partnerships. Our proactive approach and continuous improvement culture underscore our commitment to meeting and exceeding CPS 230 requirements, providing our clients with the confidence that comes from working with a compliant and forward-thinking organisation.

Australian market leader

Composer is trusted by leading wealth management brands in Australia, from top tier banks to boutique providers. We support over two million investor accounts and power some of the market’s leading propositions.

Flexible and modern platform

Technology to deliver the functionality you need to optimise your business:

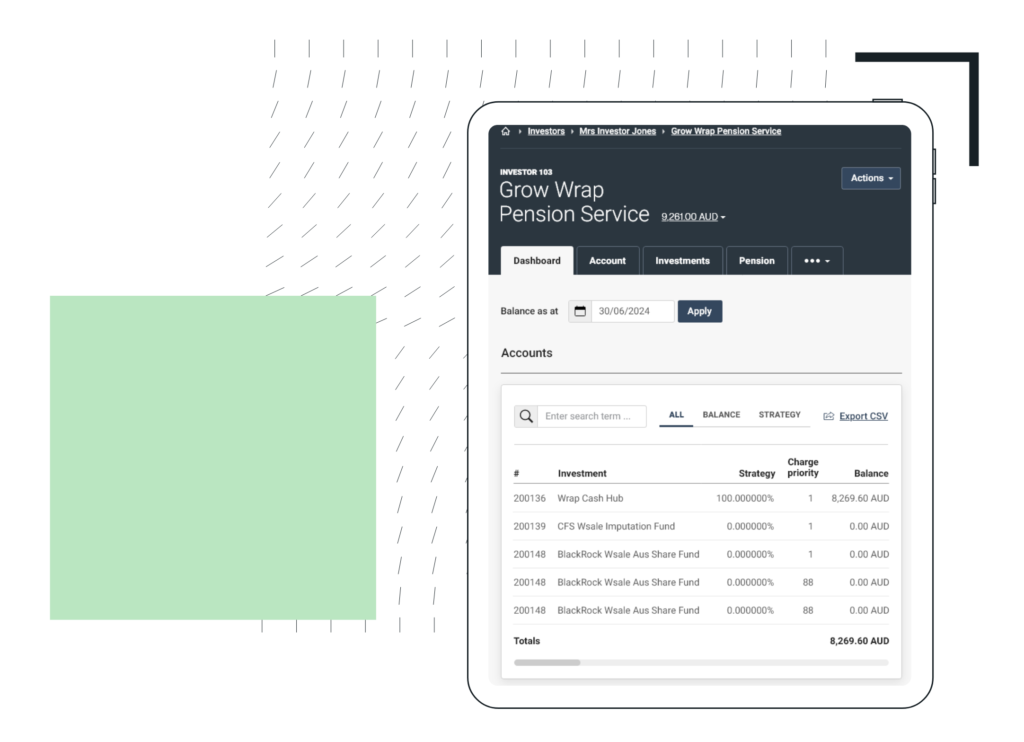

- Intuitive user experience – get new users up and running quickly and reduce likelihood of errors with easy navigation and guided journeys

- Easy integration – a suite of integration services to increase efficiency, reduce risk and increase opportunity for innovation

- Modular design – add new products and services as your proposition evolves with simple and flexible configuration

- Modern technology – lower cost of ownership and ensure scalable, resilient and secure service delivery with on premise or cloud hosted solution

Scalable API framework

Our APIs allow your business to easily create, update or read data in Composer through integration with your existing systems and applications.

Access to information within Composer can power digital interfaces used by advisers and investors with real-time data. Populating user profiles with rich insights and consolidated information from across your business enhances the user experience for your clients.

Using our APIs can promote increased self-service capability, reducing paper instructions and the dependency on operational staff to perform key servicing activities.

Composer key features

Centralise your back office

Composer is a client centric solution with a wide range of product wrappers. It allows you to centralise back book and new propositions onto a single platform.

Products support include:

- Cash – Interest (including Term) Products

- Superannuation – both corporate and personal

- Unit trust – both wholesale and retail

- Investment Platforms – Wraps, IDPS and other

- Allocated Pensions and Annuities

- Life Insurance – Policy Administration

- Loans Administration

SuperStream integration

Superannuation funds can combine Composer with our SuperStream Gateway solution to deliver true straight through processing for ATO messages. Linking the platforms will reduce your technology costs and increase efficiency.

Our SuperStream Gateway sends and receives superannuation documents to and from other SuperStream participants. All messages are sent, received and stored for auditing purposes according to Australian Taxation Office (ATO) standards to ensure complete compliance.

“Our relationship is stronger than it has ever been, and we are delighted with GBST as a provider for both Aegon and our new relationship with Nationwide and the 15 million customers they have. This is down to the continuous dedication of the GBST implementation team meeting aggressive deadlines and working in collaboration with Aegon IT and business teams. GBST very much take a partnership approach.”

Managing Director

Aegon