Optimise tax in the investment process

Tax Analyser

Digital platform helping superannuation funds improve after-tax returns for members by optimising tax in the investment process

Improve after-tax returns

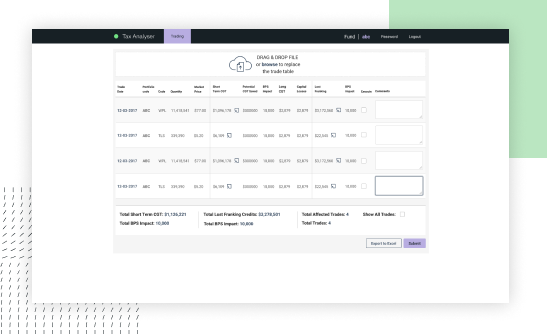

Tax Analyser is a web-based tool that builds tax decisions right into the investment process – helping superannuation fund managers understand the after-tax impact of investment decisions in real time without having to understand the complexity of the tax rules. Using a sophisticated post-trade analytics engine, Tax Analyser examines the fund level tax implication (CGT and Franking credits) on a proposed trade on a pre-trade basis, and measures the after-tax performance contribution of each manager. Easy-to-read and interpret benchmark reports provide accurate measurements of post-trade, after-tax portfolio value.

Tax-aware investing

By aligning the benchmark with their clients’ measurement criteria, superannuation fund managers are able to ensure they are focusing on each individual’s desired investment outcomes. With this kind of tax-aware approach, fund managers are able to improve the real return on investment for their clients. Fund managers are also able to record why they did or didn’t make a particular investment decision – improving transparency of performance by giving super funds access to thought processes and ensuring that best practice standards have been adopted.

Tax Analyser is patented by GBST, and there is no other tool exactly like it on the market that gives superannuation fund managers the power to make the best investment decisions for their clients.

Rules-based configuration

Built using a rules-based infrastructure, GBST’s tax engine can handle any complexity of investment tax. That means we can shape a solution to suit the needs of each fund’s specific aims and goals while also making it easy for fund managers to deliver the results that fit their clients’ investment strategies.

Secure and centralised

As Tax Analyser is a web-based app that superannuation fund managers use to access their own accounts and information, the IP address of each manager is protected – so super funds can centrally monitor the activities of all fund managers while no fund manager can see another’s information.

Combined with After-Tax Benchmark and Analytics, your fund can create a ‘whole of fund’ view of tax optimisation enabling you to deliver tax aware, improved member outcomes.