First published on bobsguide

The banking sector is often a leader in cutting-edge IT. SWIFT established a global financial messaging standard. High-frequency trading has encouraged technology vendors to keep pushing the limits of their hardware and software. Occasionally, though, our industry trails behind the technological advances we see elsewhere. Since security and reliability are paramount in any technology project, banks and brokerages are not always free to adopt solutions that are popular in other industries. In investment banking, software bugs can lead to financial loss or reputational damage, requiring a measured approach to change.

Business Intelligence in banking is one area that has not necessarily kept up with advancements outside the industry. Both inside the banking industry and out, business intelligence tools have evolved significantly over time. These improvements have changed how our work gets done. Until recently, BI analysts were limited to tabular reports that might only be updated daily or weekly. Today, clients, advisors, and brokers all expect information to be presented instantaneously and in just the right way—but it’s easy to be disappointed by the tools available to investment banks. As a retail banking customer, you can pull out your phone and perform a myriad of useful actions, such as checking the balance and transaction history of multiple accounts and easily execute transfers and payments. Why aren’t these kind of tools equally widespread in investment banking? How can banks and brokers act on this opportunity for improvement?

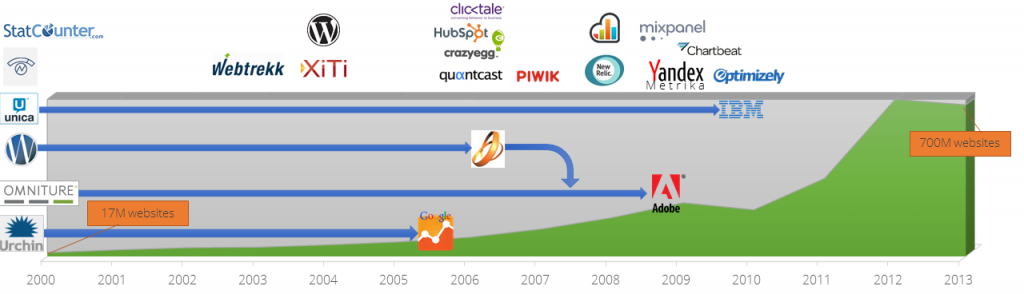

For some insight, let’s compare this situation with another industry. In e-commerce & marketing, web analytics—the process of tracking who’s visited your website and where they are from —has followed a similar history. There is a big difference between the tools available to marketers compared to those for financial analysis. The web analytics market is dominated by a single free product: Google Analytics.

Even in the early days of the web, marketers knew there was value in understanding their customers’ behaviour, but the path to the best solution was unclear. Through the 90s and until 2005, the industry relied on in-house software and a handful of expensive vendors with capabilities that would seem very limited by today’s standards. In 2006, after acquiring one of those vendors, Google began offering its Analytics solution for free and the landscape changed forever. Soon, Google was serving the majority of the market, with all other vendors fighting for second place.

Figure 1: Development of web analytics tools

Source:

- “A Brief History of Web Analytics”, ClickTale blog, November 17, 2010

- “The Evolution of Google Analytics: A Timeline”, measureful, February 27, 2014

- Google play app shop

Google’s dominance wasn’t all bad for its competitors, since it grew the customer base so quickly. Once marketers were introduced to analytics, many wanted more customized solutions. New vendors entered the market. Some offered a simpler, straight-forward interface that could be used by anyone. Others offered more direct control of the data being collected (since Google Analytics uses sampling in certain cases). Many competitors differentiated themselves with specific insights that went beyond the data presentation options that Google provided.

Figure 2: Snapshot of competition in web analytics business

The introduction of Google’s free Analytics service didn’t close the market to competition, but instead spurred the founding of many new start-ups, along with a few additional corporate acquisitions.

So where is the Google Analytics of business intelligence for the investment banking industry? Why doesn’t the banking industry have a free solution to turn big data into compelling graphics with just a few lines of code? To answer that, we need to consider the full cost of Google Analytics. It wasn’t a coincidence that Google Analytics was launched at the same time as their AdSense ad-serving platform. By analysing customer behaviour on Google’s servers, Google is able to learn as much about website visitors as actual owners of the site—maybe even more. For banks and brokers, this kind of arrangement is almost always unacceptable. With no profitable opportunity for a company like Google to offer business intelligence solutions to anyone and everyone, banks and brokers are missing out on the “free lunch” enjoyed by marketers.

Although data analysis solutions in banking are currently trailing those used in web analytics, our industry can benefit from their lead. More and more, web frameworks, mobile platforms, and charting libraries are doing the grunt work in software projects, even if they were originally developed for other industries. By connecting existing, well-established technologies, it’s become easier to build custom tools for brokers, banks, and their customers. With real-time business intelligence no longer limited by technology, the banking industry can focus on the other factors necessary to turn raw numbers into useful results.

So what needs to happen for the investment banking workflow to move on to your mobile phone or tablet? On the back-end, data sources must continue to be securely integrated. On the front-end, modern, general-use interface tools need to be moulded into domain-aware solutions.

Today, data systems remain relatively segregated into traditional back, middle, and front office silos. Clearing and settlement details may not be accessible in systems used by advisors and end investors. Secure passage of information between these systems, or even the introduction of cross-silo systems, will allow new workflows and establish new opportunities to increase client value. This will allow clients, advisors, and back-office staff to see a more complete picture of the business and operate more effectively.

Web analytics and other business intelligence products have driven the development of software libraries from a variety of vendors and open source projects. Similarly, web and mobile development platforms have made it easier than ever to create tools for the banking industry. No one needs to start from scratch—they just need to focus on business requirements. With this advantage, banking software will be able to provide on-demand analysis and actionable insights, not just static tables.

With the right tools, technology should become transparent to the process. Brokers, advisors, and clients alike will be able to forget the tools are there and focus instead on communicating with one another.

Posted in: